Long-term care planning is the art of helping you find, get and pay for good long-term care. Paying for care frequently requires Medicaid planning. The heart of Medicaid planning is the ability to make those changes necessary to move you from where you are to where you want to be. With that in mind, this page addresses what the Medicaid rules say about restructuring your estate. However, you should never make changes to your estate plan without first seeking advice from an Elder Law Attorney and a tax professional. The examples provides below are only a few Medicaid planning concepts. For example, divorce is not discussed below, although it is a Medicaid planning option in some cases. Converting countable resources into an income stream for a Community Spouse is not discussed below, but it is a planning option in some cases. Purchasing long-term care insurance is an excellent plan, or plan component, but it is not discussed here. Every case is unique because every person’s family circumstances and financial circumstances are unique. There are many Medicaid Planning options and only a few are discussed here.

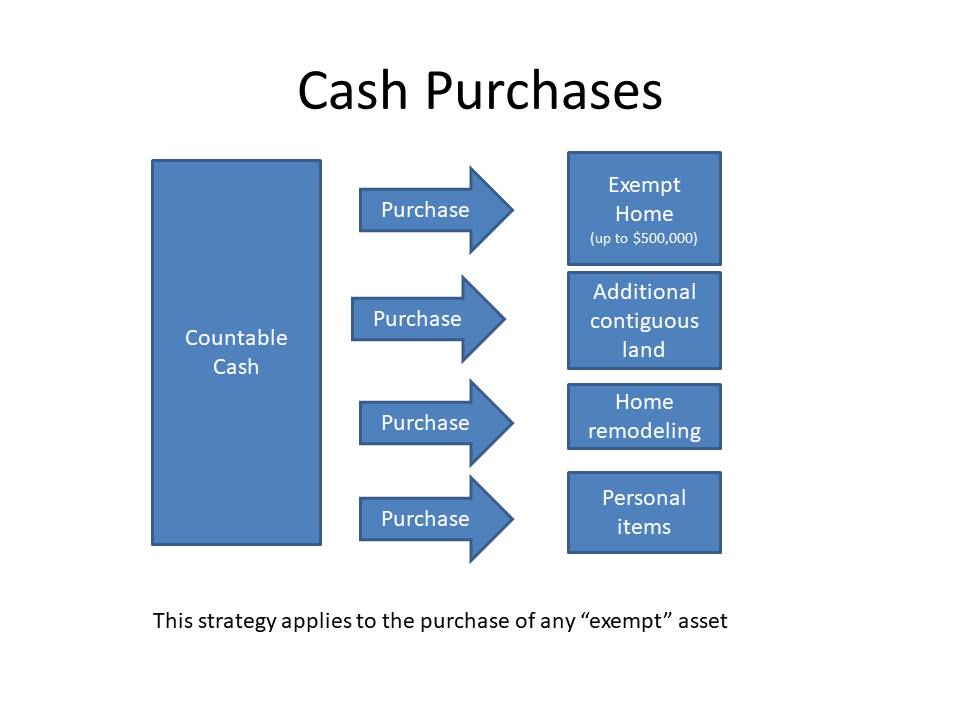

Purchasing Exempt Resources. You can always spend money on yourself or your spouse. Purchases of additional exempt resources will accelerate Medicaid eligibility.

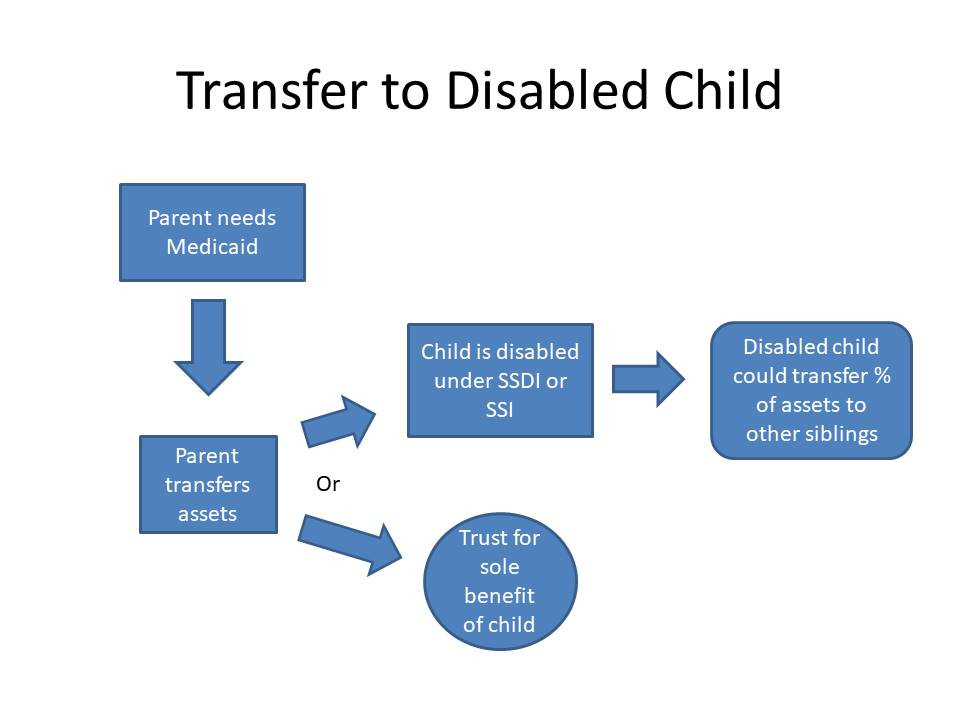

Making Gifts to a Disabled Child. As discussed in Medicaid’s Transfer Penalty, a gift to a disabled child or to a trust for a disabled child is exempt from the penalty rules.

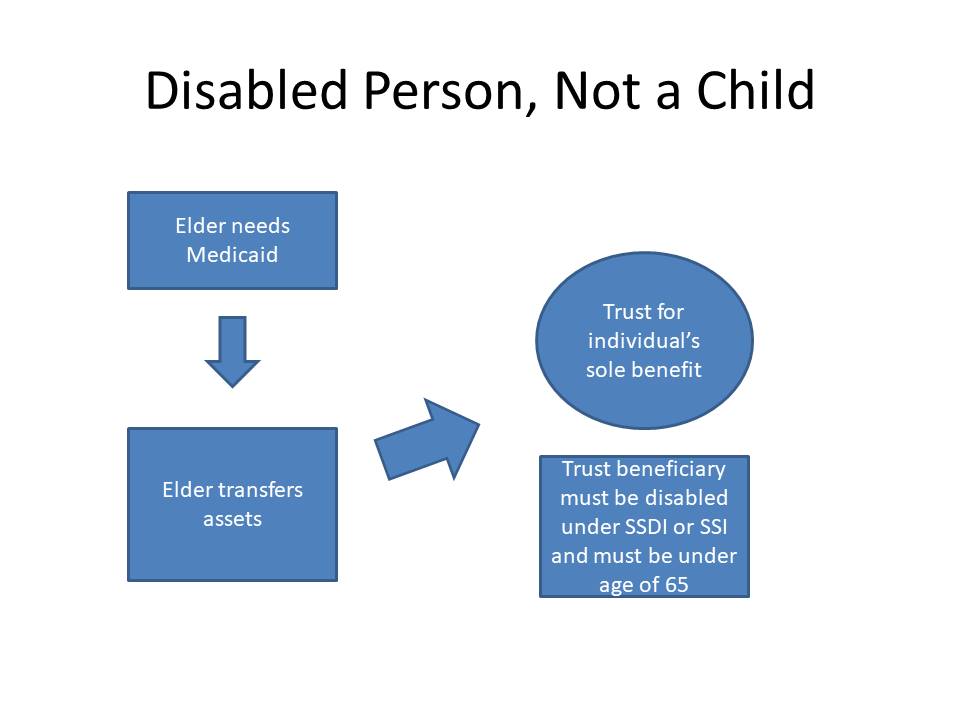

Gifts to a Trust for a Disabled Individual Under 65. As discussed in Medicaid’s Transfer Penalty, a gift to a trust for a disabled individual under the age of 65 is exempt from the penalty rules

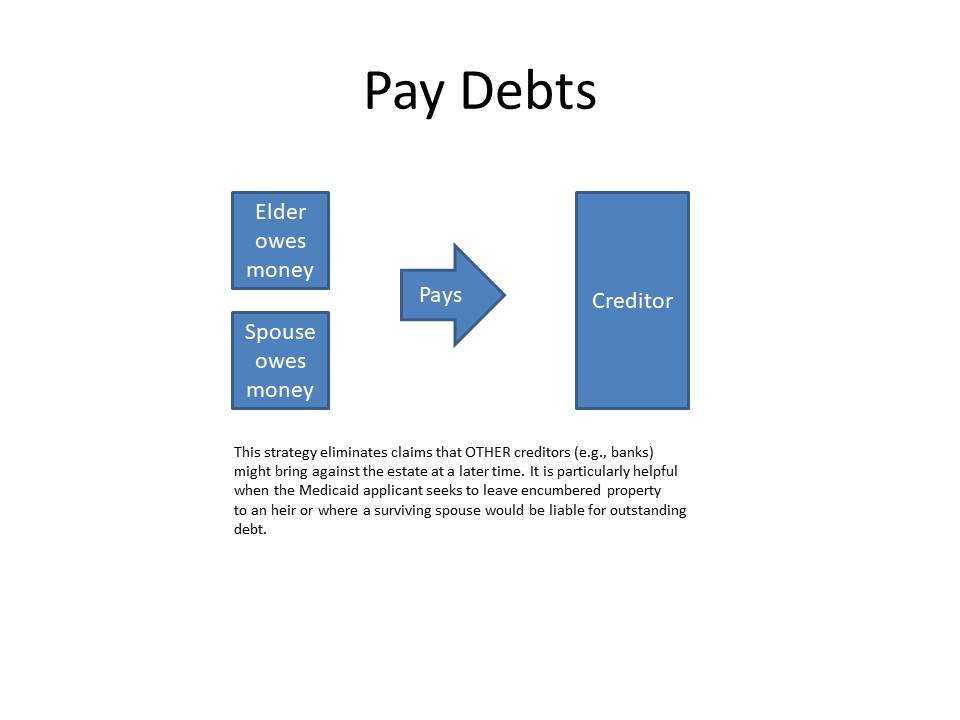

Paying Debts. You are allowed to pay off debt or pay down debt without triggering a transfer penalty. This may benefit an applicant or the Community Spouse of an applicant since it has no impact on net worth and eliminates the need for income to make debt payments.

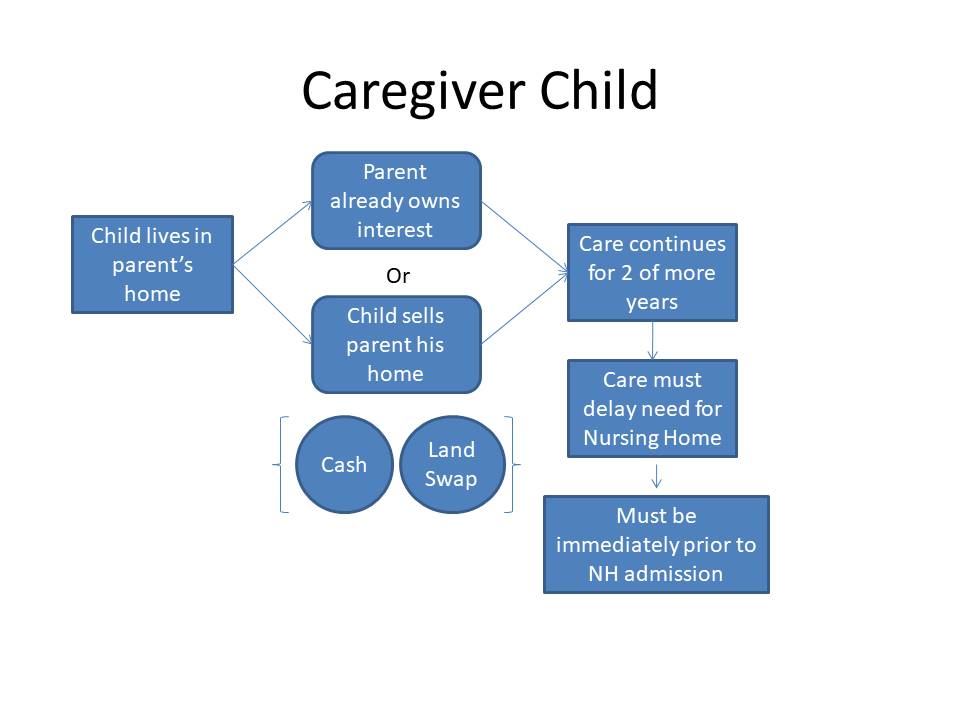

Transferring home to a caregiver child. As discussed in Medicaid’s Transfer Penalty, transferring a home to a caregiver child does not trigger a transfer penalty. However, the facts proving that the child satisfied the exception must be proven.

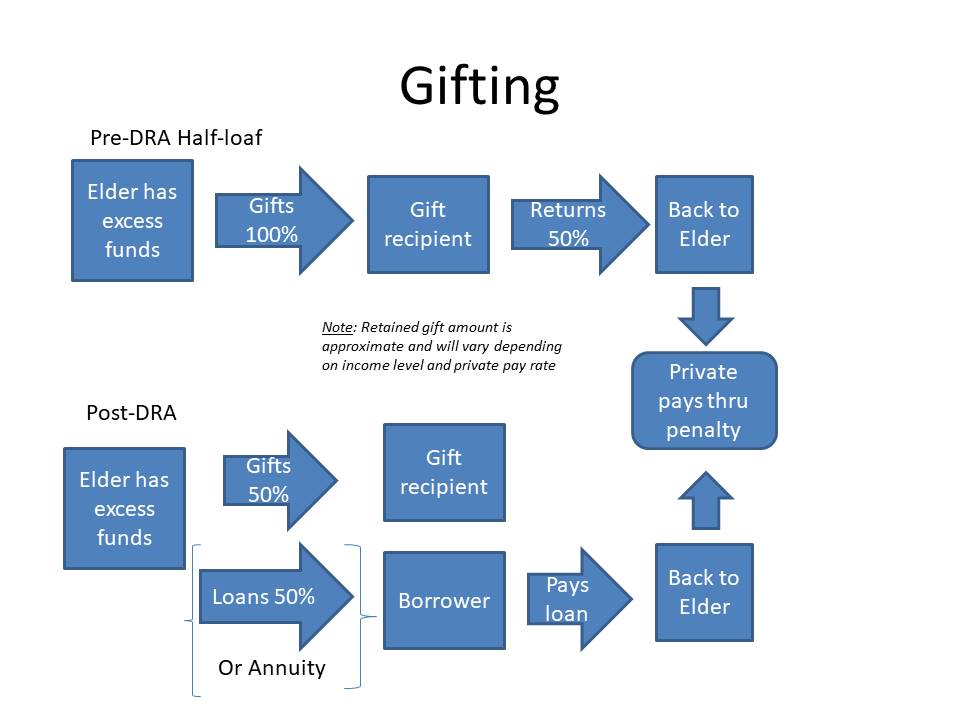

Gifting. As discussed in Medicaid’s Transfer Penalty, a gift typically triggers a transfer penalty. Therefore, gifts should never be attempted without professional advice. Further, the actual amount of the gift will not be 50% as used in the illustration. That is an approximation. Calculation of the gift amount requires the planner to take a number of factors into account, such as the applicant’s monthly income, the actual cost of care during a penalty period, and other monthly expenses incurred during a penalty period such as payment of a Medicare Supplement premium.

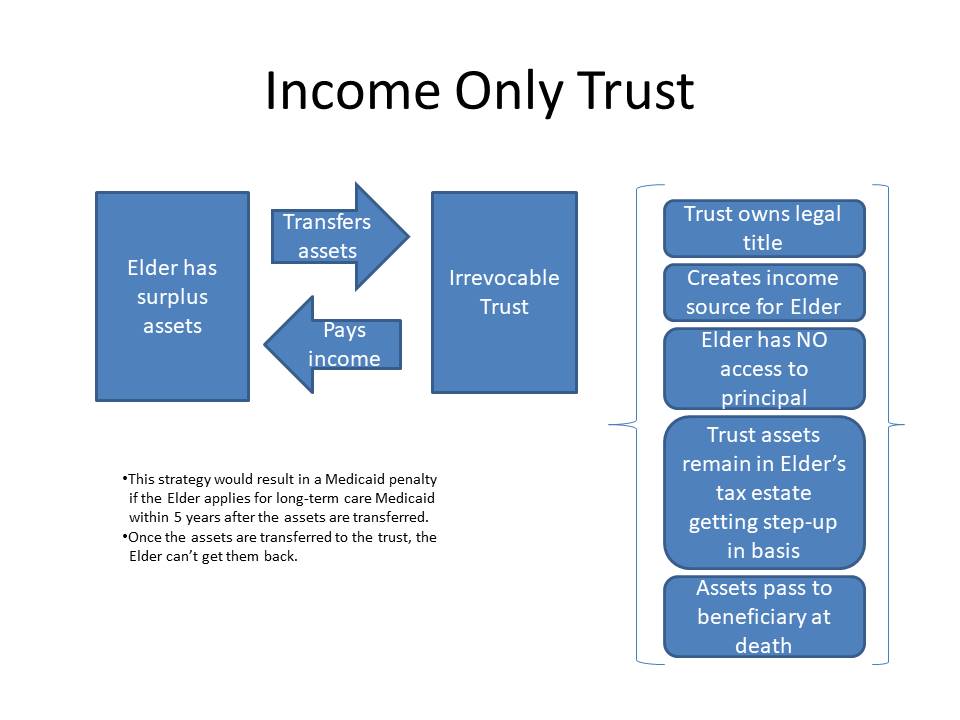

Income Only Trust. This strategy presumes the future Medicaid applicant can wait at least 60 months before applying for Medicaid. As discussed in the Streimer Letter, only the income interest is available to the applicant, so the principal is protected if it was transferred more than 60 months prior to the application, or is subject to Medicaid’s Transfer Penalty Rules if it was transferred within the 60 month look back period. One advantage to income only trusts is that trust assets remain in the applicant’s estate for purposes of determining whether they receive a step-up in basis following the beneficiary’s death when determining whether capital gains taxes are owed.

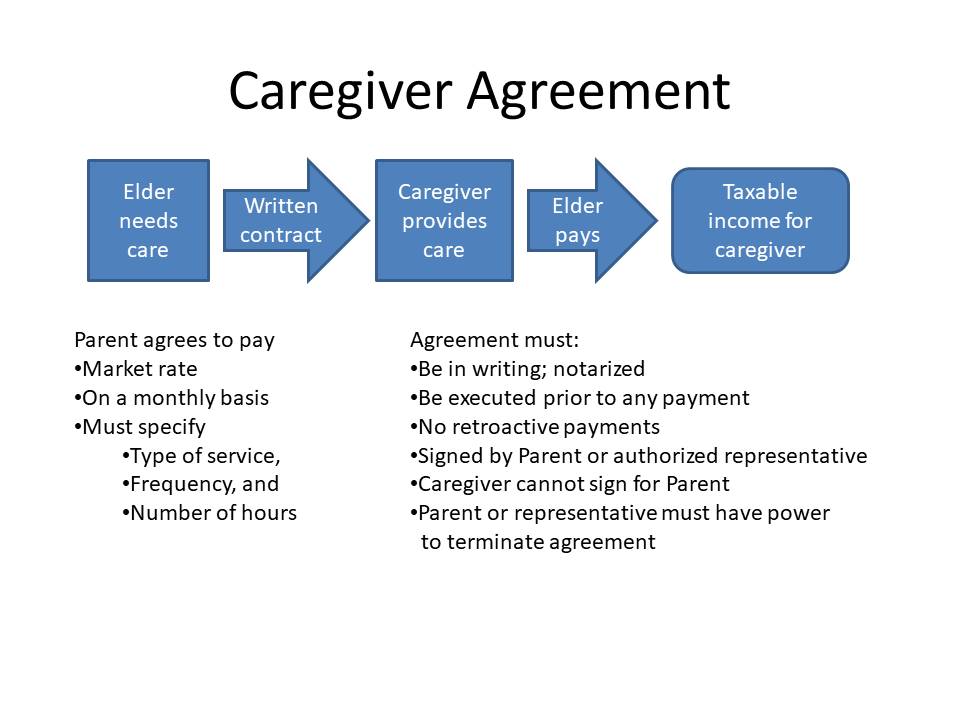

Caregiver Agreements. Although Medicaid presumes family caregivers would provide care for free, and that any payment made by a Medicaid applicant is a gift, that presumption can be rebutted if a written caregiver agreement is in effect prior to the time care is given. The rules governing caregiver agreements vary from state to state. The following illustration is consistent with Georgia’s ABD Manual. See our page “Can I get paid to be a caregiver for a family member?” for more information on caregiver agreements.

There are many other Medicaid planning options. Some of them will be discussed in future blog posts and others might be discussed as this page is expanded. HOWEVER, you should always seek experienced legal counsel before attempting any of these stratigies on your own. Elder Law Attorneys make more money cleaning up your mess than they charge if you let them do things right the first time.