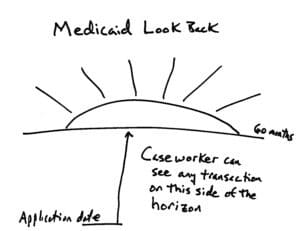

Because Medicaid is a welfare program, you must be poor enough (under its program rules) to qualify. Some people try to become eligible by giving resources away. 42 U.S.C. § 1396p(c)(1) creates what is known as the “Look Back Period.” It is the period of time during which Medicaid can second guess any action you took to give away resources for the purpose of becoming eligible for Medicaid. When a caseworker looks at transfers or cash transactions, he or she is looking for gifts that can be penalized. If a gift occurred at any time during the 60 months immediately prior to an application for long-term care or hospital Medicaid (or many waiver programs), the gift will trigger a penalty.

Sweet heart deals disguised as sales are also gifts. Any so-called sale for less than fair market value is considered a partial gift, with the amount of the gift being the difference between the sale price and the fair market value of the transferred property. If the gift occurred during the Look Back Period (even if it was 59 months ago), then the caseworker can take it into account and impose a penalty.

Subsection (A) provides: In order to meet the requirements of this subsection for purposes of section 1396a(a)(18) of this title, the State plan must provide that if an institutionalized individual or the spouse of such an individual (or, at the option of a State, a noninstitutionalized individual or the spouse of such an individual) disposes of assets for less than fair market value on or after the look-back date specified in subparagraph (B)(i), the individual is ineligible for medical assistance for services described in subparagraph (C)(i) (or, in the case of a noninstitutionalized individual, for the services described in subparagraph (C)(ii)) during the period beginning on the date specified in subparagraph (D) and equal to the number of months specified in subparagraph (E).

Subsection (B) provides: (i)The look-back date specified in this subparagraph is a date that is 36 months (or, in the case of payments from a trust or portions of a trust that are treated as assets disposed of by the individual pursuant to paragraph (3)(A)(iii) or (3)(B)(ii) of subsection (d) or in the case of any other disposal of assets made on or after February 8, 2006, 60 months) before the date specified in clause (ii).

(ii)The date specified in this clause, with respect to—

(I)an institutionalized individual is the first date as of which the individual both is an institutionalized individual and has applied for medical assistance under the State plan, or

(II)a noninstitutionalized individual is the date on which the individual applies for medical assistance under the State plan or, if later, the date on which the individual disposes of assets for less than fair market value.