Qualified Income Trusts are frequently referred to as “Miller Trusts.” The reason is because they originated following a decision in Miller v. Ibarra, 746 F. Supp. 19 (D. Colo. 1990). There, four plaintiffs including Jeanette Miller, created income trusts to avoid a technical trap known as the “Utah Gap.” The Court, which ruled in favor of the Plaintiffs, began with the following summary of their situation: “The legal representatives of four aged, infirm and mentally incompetent women commenced this lawsuit in an effort to extricate their charges from the “Utah Gap.” That is the popular nomenclature for a “Catch 22″ in state health care policy that deprives many senior citizens of Medicaid payments for nursing home expenses to which they are otherwise entitled. When their incomes are too low to enable them to pay their own nursing home costs, but too high to qualify for Medicaid benefits, these claimants are ensnared in a trap created by the interaction of highly technical federal and state statutes and regulations. They are not allowed to pay as much as they can, and have Medicaid pay the balance, but instead are totally disqualified for any Medicaid assistance.” In 1993, Congress codified this remedy at 42 U.S. Code § 1396p(d)(4)(B).

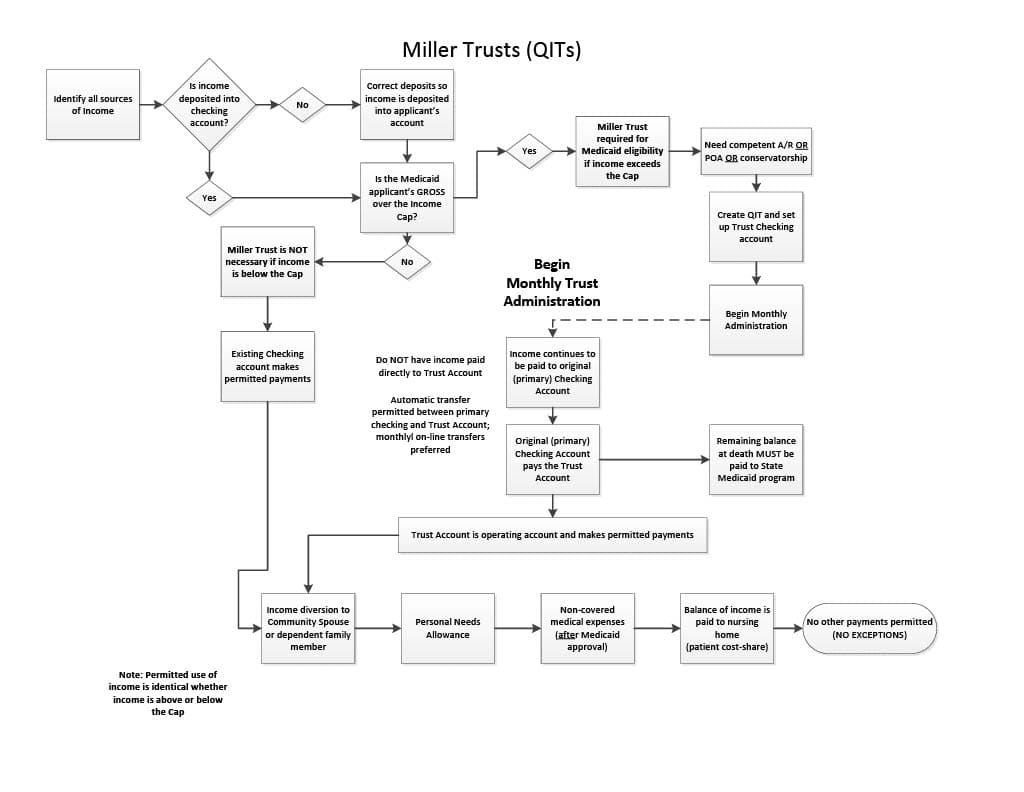

The only person who needs a Qualified Income Trust (aka QIT, Qualifying Income Trust or Miller Trust) is the person applying for Medicaid. The applicant only needs a QIT if GROSS monthly income exceeds the current year’s income cap. If anyone tells you the Community Spouse needs a qualified income trust, or that the Community Spouse’s income causes the applicant to need a QIT because the couple’s income is combined, then you should run because the person telling you that is proving that he or she is ignorant regarding the Medicaid rules. The chart below tells you whether you need a QIT and, if so, what to do with monthly income.

Essentially a Miller Trust or QIT is federally approved money laundering.

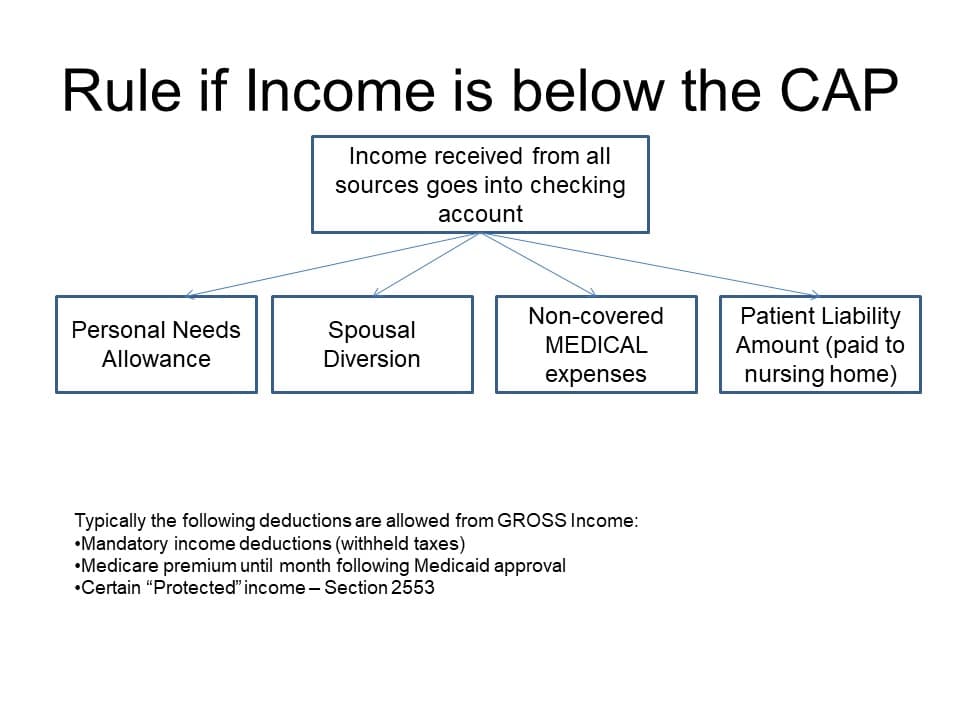

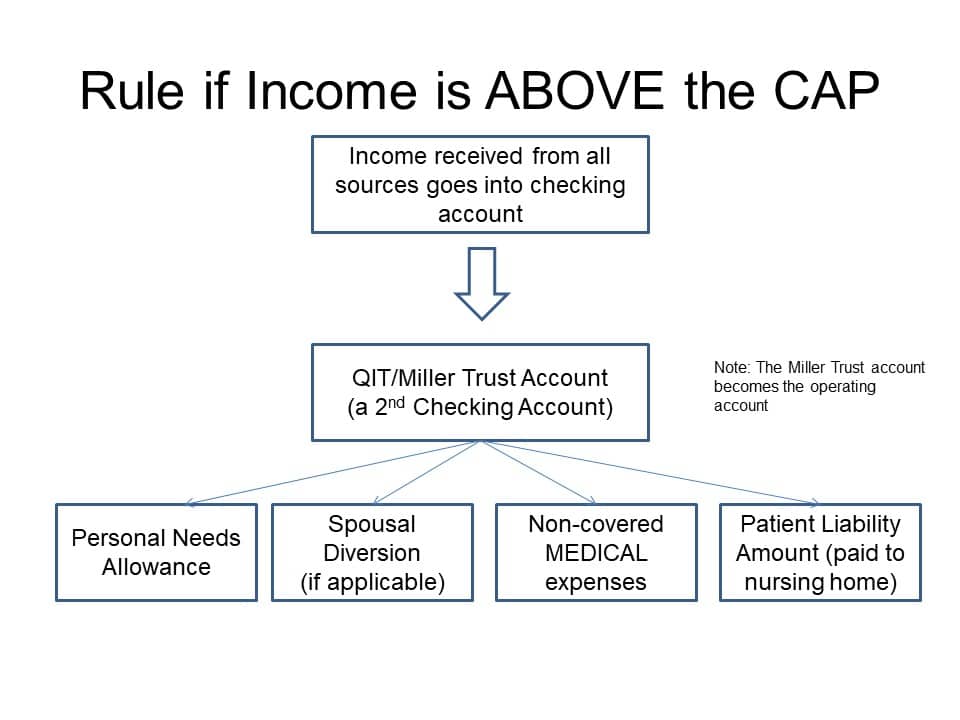

Now, let’s say gross monthly income is at lease 1 penny above the income cap. The following illustrations shows how the QIT must be used:

The only significant difference in the two examples is that when income exceeds the income cap, you become eligible by flushing it through the separate QIT account. The QIT account becomes your operating account. You must flush income through it on a monthly basis and pay required bills on a monthly basis. Ideally, the QIT accounts should be as close to zero as possible each month because the State gets any remaining funds when the Medicaid recipient dies.

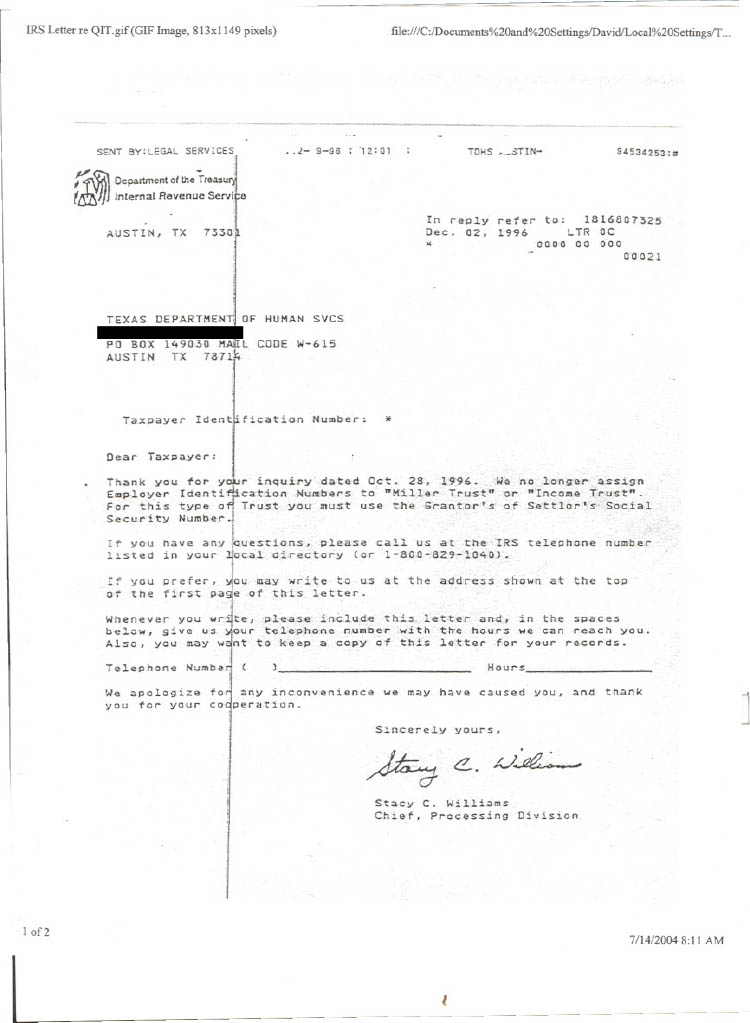

Most elder law attorneys will draft a QIT for you if you’ve hired them to assist with your Medicaid application. Once you have your QIT trust agreement, take it to the bank and set up the new account. Although many trusts require a separate tax payer id number (EIN), a QIT does not. A copy of the IRS letter saying that it will use the applicant’s Social Security number is below.

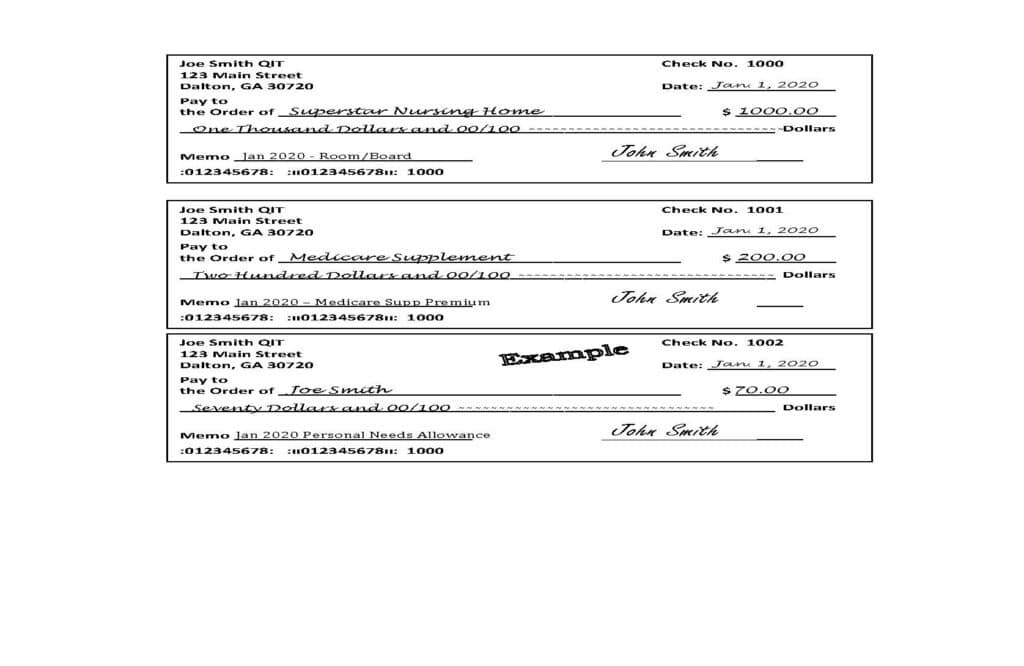

Ideally, you will set up the QIT account at the same bank where income is deposited. That way its easier to move money. Then, EACH month beginning during the month when Medicaid eligibility is needed, you will move substantially all of the applicant’s income from the main account (where income is deposited) to the QIT account. You will then pay the patient cost share from the QIT. You can also pay other permitted deductions from the QIT , such as health insurance premiums, payments toward medical debt that was incurred within 90 days prior to the application, diversions of income to a low income Community Spouse and the $70 personal needs allowance.

After you set up the new QIT account, your attorney will need copies of the bank account paperwork proving the account was established and proof that it was funded. Medicaid can ask for copies of all checks every six months if they choose to audit how the account is operated.

Examples of the checks you would write from the QIT are below:

If you have an attorney, ask questions regarding anything you don’t understand. The video below was made several years ago, but other than recognizing that it doesn’t use the current year’s numbers, in about 30 minutes, it explains how to use a QIT.

A Trustee Guide published by the Department of Community Health appears below:

Loading...

Loading...