After an individual dies, it is often necessary to take action to deal with property and debts the decedent left behind. Property owned by a deceased person at the time of his or her death may be inaccessible. It will also be subject to debts owed by the deceased individual. Since the law disfavors allowing dead people to own property, we sole this problem either by probating the deceased individual’s Will, or by administering the deceased person’s estate.

What is the Probate Estate?

Not all assets are subject to probate or administration. Sometimes assets pass directly to co-owners or beneficiaries by other means; assets that pass by statute, deed or contract are not part of the probate estate. See Morris v. Morris, 326 Ga. App. 378 (2014) (if decedent did not hold legal title to property, it does not become part of the decedent’s probate estate); M. Radford, Redfern: Wills and Administration in Georgia, § 2.4 (Non-probate transfers) (“The transfer of [assets outside of probate] generally is not subject to the terms of the testator’s will, nor to the statutes that decree the heirs to whom an intestate decedent’s property will pass.”); and see Investopedia, Probate (discussing non-probate assets such as insurance and retirement plans which pass outside of probate). The probate estate is limited to those assets owned by the deceased individual that require Court intervention to pass from the deceased to living heirs. Be careful though. Different rules apply in different contexts. For example, when the IRS is determining the extent of a taxable estate, non-probate assets may be included in the taxable estate even if they are not part of the probate estate.

Small Estates

Georgia does not have a “small estate” form, but it does allow banks to disburse accounts with a balanec under $15,000 if the appropriate affidavit is submitted under penalty of perjury. See O.C.G.A. § 7-1-239; Instructions & Affidavit for Obtaining deceased Depositor’s Funds. Smilarly, vehicles may be transferred using the Department of Motor Vehicles Affidavit of Inheritance.

Probate vs. Administration

If the decedent left a valid Will, the process used to make the Will effective is called Probate; an un-probated Will gives no one authority to act. If the decedent died intestate (without a Will), the estate must be administered. In Georgia, probate and administration occur in the Probate Court. Definitions used throughout the Code appear at O.C.G.A. § 53-1-2. Jurisdiction is in the Probate Court in the county of decedent’s domicile at the time of death; however, admission to a nursing home or similar facility shall not be presumed to change the decedent’s domicile. O.C.G.A. § 53-5-1. See How do I open an Estate in Georgia?

General Rules Regarding Administration and Probate; identification of heirs-at-law:

If someone dies without a Will, probate assets pass to that person’s heirs-at-law, which are typically defined by statute in each State. Non-probate assets, such as Securities registered in beneficiary form, are not subject to the provisions discussed here.

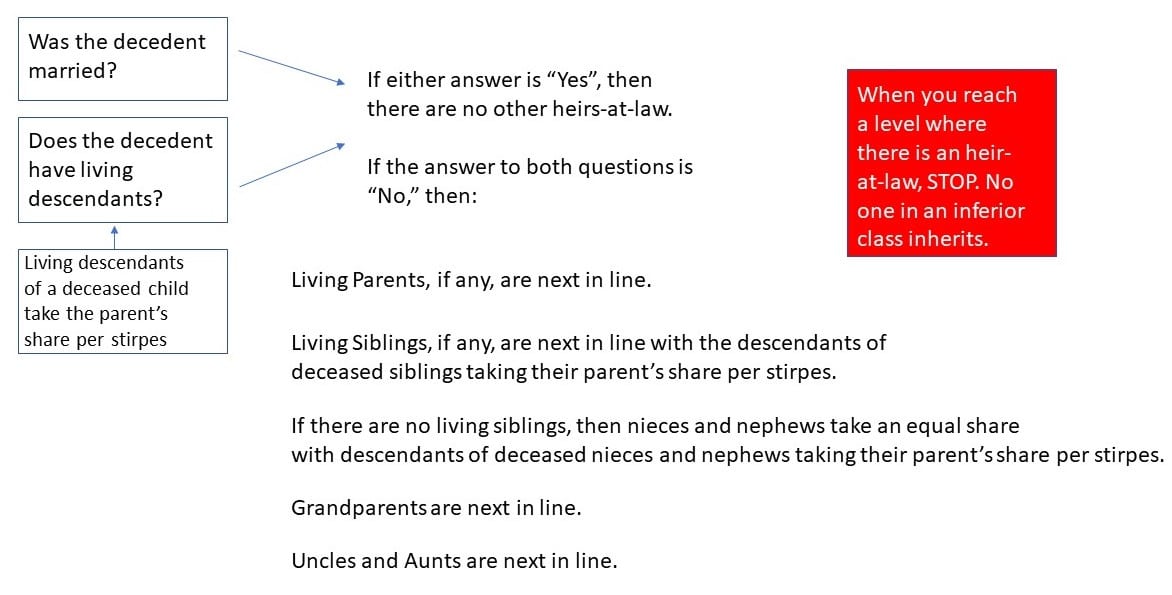

The process begins when a Petition for Probate or a Petition to Administer an estate is filed in the Probate Court. Regardless of whether the estate is probated or administered, it is necessary to identify heirs-at-law. Heirs at law must be notified even if there is a Will because they have legal standing to challenge the validity of the Will. The image below is an attempt to simplify O.C.G.A. § 53-2-1(c) which identifies an individual’s heirs-at-law as follows:

Except as provided in subsection (d) of this Code section, when a decedent died without a will, the following rules shall determine such decedent’s heirs:

(1) Upon the death of an individual who is survived by a spouse but not by any child or other descendant, the spouse is the sole heir. If the decedent is also survived by any child or other descendant, the spouse shall share equally with the children, with the descendants of any deceased child taking that child’s share, per stirpes; provided, however, that the spouse’s portion shall not be less than a one-third share;

(2) If the decedent is not survived by a spouse, the heirs shall be those relatives, as provided in this Code section, who are in the nearest degree to the decedent in which there is any survivor;

(3) Children of the decedent are in the first degree, and those who survive the decedent shall share the estate equally, with the descendants of any deceased child taking, per stirpes, the share that child would have taken if in life;

(4) Parents of the decedent are in the second degree, and those who survive the decedent shall share the estate equally;

(5) Siblings of the decedent are in the third degree, and those who survive the decedent shall share the estate equally, with the descendants of any deceased sibling taking, per stirpes, the share that sibling would have taken if in life; provided, however, that, subject to the provisions of paragraph (1) of subsection (f) of Code Section 53-1-20, if no sibling survives the decedent, the nieces and nephews who survive the decedent shall take the estate in equal shares, with the descendants of any deceased niece or nephew taking, per stirpes, the share that niece or nephew would have taken if in life;

(6) Grandparents of the decedent are in the fourth degree, and those who survive the decedent shall share the estate equally;

(7) Uncles and aunts of the decedent are in the fifth degree, and those who survive the decedent shall share the estate equally, with the children of any deceased uncle or aunt taking, per stirpes, the share that uncle or aunt would have taken if in life; provided, however, that, subject to the provisions of paragraph (1) of subsection (f) of Code Section 53-1-20, if no uncle or aunt of the decedent survives the decedent, the first cousins who survive the decedent shall share the estate equally; and

(8) The more remote degrees of kinship shall be determined by counting the number of steps in the chain from the relative to the closest common ancestor of the relative and decedent and the number of steps in the chain from the common ancestor to the decedent. The sum of the steps in the two chains shall be the degree of kinship, and the surviving relatives with the lowest sum shall be in the nearest degree and shall share the estate equally.

Subsection (d), mentioned above, provides that a parent who abandoned his or her child has no right to inherit from a deceased minor child. Pursuant to O.C.G.A. § 53-1-8, adopted individuals are treated the same as blood relatives if someone dies without a Will. O.C.G.A. § 53-2-3 provides that children born out of wedlock are treated the same as legitimate children with respect to their mother’s estate; with respect to the father’s estate, there must be some evidence of paternity. Similarly, O.C.G.A. § 53-2-4 provides that a mother may inherit from a child born out of wedlock, but a father may not unless paternity was established. If the spouse of an intestate decedent dies within six months and has no ascertainable heirs, then any undistributed property reverts back to the original decedent as if the spouse predeceased; the purpose of this provision is to prevent escheat to the State. See O.C.G.A. § 53-2-8. When the identity or interest of an heir must be established, that issue is usually resolved by the Probate Court, but may be resolved in the Superior Court of the same county as the Probate Court if the estate is uncontested. See O.C.G.A. § 53-2-20. Any person who has a duty to distribute property may file a Petition for determination of heirs, see O.C.G.A. § 53-2-21, as can any individual claiming to be an heir. See O.C.G.A. § 53-2-22. With good cause, disinterment for the purpose of DNA testing is within the Court’s discretion. See O.C.G.A. § 53-2-27. The findings of the Probate Court or Superior Court are binding on all person and every issue decided. See O.C.G.A. § 53-2-26. (Unlinked Code sections can be found through our Finding the Law page)

Pending administration, property owned by an intestate decedent is held as provided in O.C.G.A. § 53-2-7.

See Athens-Clark County Probate page for a flow chart to identify heirs at law. See also Heirs Determination Worksheet from Probate Court of Cobb County.

Petition to Probate Will.

Anyone in possession of a Will made by a Georgia decedent has a duty to file it. O.C.G.A. § 53-6-1. Some Wills are not executed properly. A codicil purporting to republish the Will is proof of the Will and can cure those defects. O.C.G.A. § 53-5-7. There is a presumption that a lost Will was revoked, but that presumption can be rebutted by a prepondence of the evidence.

A Georgia Will may be offered for Probate in Common Form or Solemn Form. O.C.G.A. § 53-5-15. The named executor has the right to offer a Will for probate, but any interested party may file the Petition if the named executor fails to do so, O.C.G.A. § 53-5-2, and any individual who is sui juris may qualify to serve as personal representative or administrator of an estate. O.C.G.A. § 53-6-1. If an individual is nominated in the Will to serve as executor and chooses not to serve, most courts require that a renunciation be filed (or a death certificate if the named executor is deceased). Of course, a 2022 case out of Nebraska points out that a representative who chooses not to serve cannot be drafted or appointed involuntarily.

A will may be proved in common form upon the testimony of a single subscribing witness and without notice to anyone. If the will is self-proved, compliance with signature requirements for execution is presumed and other requirements for execution are presumed without the testimony of any subscribing witness. O.C.G.A. § 53-5-17(a). Common form not conclusive for four years O.C.G.A. § 53-5-16.

A Petition to Probate in Solemn Form is conclusive on all parties who were notified of the Petition and on all beneficiaries represented by the executor six months from the date an Order is entered admitting a Will; heirs who were not notified of the Petition are treated as if the Petition was in Common Form. O.C.G.A. § 53-5-20. As provided at O.C.G.A. § 53-5-21, the Petition shall

set forth the full name, the place of domicile, and the date of death of the testator; the mailing address of the petitioner; the names, ages or majority status, and addresses of the surviving spouse and of all the other heirs, stating their relationship to the testator; and whether, to the knowledge of the petitioner, any other proceedings with respect to the probate of another purported will of the testator are pending in this state and, if so, the names and addresses of the propounders and the names, addresses, and ages or majority status of the beneficiaries under the other purported will. If a testamentary guardian is being appointed in accordance with subsection (b) of Code Section 29-2-4, the names and mailing addresses of any persons required to be served with notice pursuant to such Code section shall be provided by the petitioner. In the event full particulars are lacking, the petition shall state the reasons for any omission. The petition shall conclude with a prayer for issuance of letters testamentary. If all of the heirs acknowledge service of the petition and notice and shall in their acknowledgment assent thereto, and if there are no other proceedings pending in this state with respect to the probate of another purported will of the decedent, the will may be probated and letters testamentary thereupon may issue without further delay; provided, however, that letters of guardianship shall only be issued in accordance with Code Section 29-2-4.

A valid Will executed in another State is proven in the same manner. O.C.G.A. § 53-5-31. The heirs who must be notified at the heirs-at-law as described above. Those are the persons with standing to object to the validity of the Will. Thus, if all heirs consent in a notarized writing to the probate, and if there is no competing Will, the Court may immediately admit the Will for probate and issue Letters Testamentary to the Personal Representative.

If there is a competing Will, then in addition to service on all heirs-at-law, notice must be given to all beneficiaries under the competing Will. O.C.G.A. § 53-5-22. Although personal service is preferred, service may also be by mail or by publication. O.C.G.A. § 53-5-22.

If a hearing or other proceeding is required to establish the Will, witnesses to the Will may give testimony pursuant to written interrogatories. They may also be deposed or compelled to appear in Court and testify. O.C.G.A. § 53-5-23. If witnesses to the Will are dead or unavailable, the Court may admit the Will upon the testimony in person or by affidavit or by deposition of at least two credible disinterested witnesses that the signature to the will is that of the individual whose will it purports to be or upon other sufficient proof of such signature. O.C.G.A. § 53-5-24. If witnesses cannot remember the circumstances of a Will’s execution or attestation, then a presumption of validity applies. In contested cases, if a settlement agreement is reached, then with the consent of all interested parties and any duly qualified representative of the estate, the Court may approve a settlement agreement even if it is contrary to the terms of the Will. O.C.G.A. § 53-5-25. The Probate Court may require evidence that a bona fide controversy exists. If a trust is involved, then a non-Article 6 court must transfer the petition for settlement to the Superior Court upon the motion or any interested party or upon its own motion. A judgment approving the settlement is conclusive in the same manner as solemn form probate. Non-judicial settlements are permitted under O.C.G.A. § 53-5-27, so long as they do not violate a material intention of the testator.

Although the named executor has priority, if none of the nominated executors are willing of able to serve, the Court may appoint an administrator with the will annexed if an estate is unrepresented. O.C.G.A. § 53-6-13. See O.C.G.A. § 53-6-14 regarding selection by beneficiaries of administrator with will annexed. The court may also appoint a successor executor if the original executor is unable to continue to serve.

Upon qualification, an Executor, Executrix or Personal Representative takes an oath to faithfully execute the terms of the Will. O.C.G.A. § 53-6-16.

Petition for Administration.

A Petition for Administration must set forth the full name, the legal domicile, and the date of death of the decedent; the mailing address and place of domicile of the petitioner; the names, ages or majority status, and addresses of heirs, stating their relationship to the decedent; and, in the event full particulars are lacking, the reasons for any omission. The petition shall conclude with a prayer for issuance of letters of administration. If a prior personal representative has qualified and a copy of the original petition is attached, it is unnecessary for the new petition to repeat relevant and unchanged information from the original petition. O.C.G.A. § 53-6-21. Heirs at law must be notified of the Petition. O.C.G.A. § 53-6-22. Upon qualification, an administrator takes an oath to administer the estate consistent with the laws of Georgia. O.C.G.A. § 53-6-24.

An Administrator may be unanimously selected by the heirs. When there is not unanimous consent, priority is given as follows: (1) The surviving spouse, unless an action for divorce or separate maintenance was pending between the deceased intestate and the surviving spouse at the time of death; (2) One or more other heirs of the intestate or the person selected by the majority in interest of them; (3) Any other eligible person; (4) Any creditor of the estate; or (5) The county administrator. O.C.G.A. § 53-6-20.

In general terms, an administrator may collect and protect assets of the estate, but unless expanded powers have been granted, must have court approval to dispose of estate assets.

Letters Testamentary or Letters of Administration.

The ultimate goal when seeking to probate or administer an estate is gaining power to take action for the benefit of the estate. That power comes from the Court, not the Will, and not the heirs. With that in mind, the following describes what is necessary to get authority from the Court to take action.

Failure to take proper action to secure court authority is a dicey proposition at best because persons who are not appointed as personal representative or administrator, and who wrongfully intermeddle with or convert personalty of the estate is an executor de son tort and is liable for double damages to the heirs or beneficiaries of the estate. O.C.G.A. § 53-6-2.

After Letters Testamentary of Letters of Administration are issued, a Notice to Debtors and Creditors should be published in the appropriate local paper for legal ads (the Legal Organ).

Powers and Duties.

The duties and powers of the personal representative commence upon qualification and relate back to ratify prior actions that were beneficial to the estate. Where insufficient power to act was given to an Executor, or where there is an administration, by unanimous consent, beneficiaries or heirs may petition the Probate Court to grant those powers contained in Code Section 53-12-261. Other powers are addressed in the remainder of Title 53, Chapter 7. Powers relating to investments, sales and conveyances are covered at Title 53, Chapter 8. Administrators may make in-kind distributions on a pro-rata basis or, with the consent of all heirs or by order of the Probate Court, may make in-kind distributions that are not pro rata. See O.C.G.A. § 53-2-30. Where a Will exists, distributions are made as provided in the Will. O.C.G.A. § 53-2-31 authorizes an Administrator to seek Probate Court approval for in-kind distributions that are not pro rata.

An an inventory must be filed with the Court unless it is waived. § 53-7-30. Also, bond is required unless it is waived. Title 53, Chapter 6, Article 6.

So long as he or she acted in good faith, a person named as executor in a purported Will may file a petition to recover expenses and reasonable attorney’s fees. O.C.G.A. § 53-5-26. A personal representative is entitled to whatever compensation the testator provided for in the Will or other writing, or by the unanimous agreement of the beneficiaries. In the absence of an agreement, the personal representative is entitled to 2 1/2 percent of all sums of money received and 2 1/2 percent of all moneys paid out. O.C.G.A. § 53-6-60. In addition, a personal representative may recover all expenses incurred representing the state or conducting its business. O.C.G.A. § 53-6-61. Where appropriate, extra compensation is permitted upon approval by the Probate Court. O.C.G.A. § 53-6-62.

No Administration Necessary.

In some cases, where there is no dispute regarding debts or how property will be distributed, administration is unnecessary. Any heir may file a Petition alleging administration is not necessary if no personal representative has been appointed. O.C.G.A. § 53-2-40. The petition shall show: the name and domicile of the decedent; the names, ages or majority status, and domicile of the heirs of the decedent; a description of the property in this state owned by the decedent; that the estate owes no debts or that there are known debts and all creditors have consented or will be served as provided in Chapter 11 of this title; and that the heirs have agreed upon a division of the estate among themselves. O.C.G.A. § 53-2-40(b). If the Petition is granted, the Probate Court must file a certified copy of the Order in each County where the decedent owned land. O.C.G.A. § 53-2-40(d). The Probate Court’s Order confirms vesting as provided in O.C.G.A. § 53-2-1 or as provided in the agreement. O.C.G.A. § 53-2-41(d), provided, legitimate creditors may still make claims against the property, or against the heirs to the extent of the value the heir received. O.C.G.A. § 53-2-42. In other words, if there are any creditor claims, a Petition alleging no administration is necessary is a poor way to deal with them.

Year’s Support.

Georgia law allows a spouse or minor child who has not married since the decedent’s death to file a creditor claim in the decedent’s estate. O.C.G.A. § 53-3-1. That claim, known as Year’s Support, is a priority claim for an amount necessary for support and maintenance for twelve months from the date of the decedent’s death. If the decedent made provision in his or her Will in lieu of Year’s Support, the the surviving spouse must make an election. O.C.G.A. § 53-3-3. If granted, property taxes and tax liens for prior years are divested in favor of the Year’s support, and property taxes the the current year, the year the petition was filed, or the year following the year when the petition was filed, are set aside as part of the Year’s Support. O.C.G.A. § 53-3-4. The Petition must be filed within 24 months of the decedent’s date of death and must set forth a schedule of property the Petitioner proposes to have set aside. O.C.G.A. § 53-3-5. Interested parties, including the tax commissioner must be notified of the Petition. If no objection is filed, the Probate Court “shall” enter an Order granting the Petition. O.C.G.A. § 53-3-7(a). If an objection is filed, a hearing must be held and the Probate Court must determine the amount to be set aside to maintain the spouse or minor child’s standard of living prior to decedent’s death, considering the following:

(1) The support available to the individual for whom the property is to be set apart from sources other than year’s support, including but not limited to the principal of any separate estate and the income and earning capacity of that individual;

(2) The solvency of the estate; provided, however, that, if the decedent dies having a deposit in a financial institution that is applied to the payment of the funeral expenses and expenses of the last illness of the decedent under subsection (c) of Code Section 7-1-239, any effect such payment may have on the solvency of the estate shall not operate adversely to the surviving spouse or any minor child in the determination of the amount to be set apart as year’s support; and

(3) Such other relevant criteria as the court deems equitable and proper.

Property that is set aside vests in the spouse or minor children in fee, without restriction as to use, encumbrance, or disposition. O.C.G.A. § 53-3-9; provided, however, Year’s Support is subject to any mortgage on the property. O.C.G.A. § 53-3-16 (real property) and O.C.G.A. § 53-3-17 (personal property subject to mortgage or security interest). If the property set aside is real property, then the Probate Court must file a certificate of the Order with the Clerk of Superior Court for the County where the land is located. O.C.G.A. § 53-3-11. If the property set aside is in the hands of a personal representative or administrator, the Probate Court may enter a writ of fieri facias (aka Fi Fa) to enforce the Order. O.C.G.A. § 53-3-12(b). A claim for years support cannot be maintained against property that was not owned by decedent at the time of his or her death. Brown v. Granite Holding Corp., 221 Ga. 560 (1965)(property that is not part of the estate cannot be set aside to satisfy a claim for year’s support); Kenner v. Kenner, 214 Ga. 381 (1958)(Where the title to property was not vested in a decedent at the time of his death, it can not be set apart as a year’s support for his widow and minor children); Napier v. Mitchell, 183 Ga. 93 (1936) (Trust property does not become part of the personal estate of a decedent and cannot be subject to the claim of a widow for year’s support).

Petitions for Year’s Support are rarely contested, but they can be contested. The purpose of Year’s Support is protect the family survivors from a reduction in their standard of living while the estate is being settled, at least for one year. Therefore, other resources and sources of income are relevant when reviewing an objection. (Exemplar discovery requests).

Temporary Administration.

The Probate Court may appoint a temporary administrator where no administrator or personal representative has been appointed. O.C.G.A. § 53-3-21. However, a temporary administrator’s authority is usually restricted to securing the estate for the benefit of creditors and heirs, and determining whether the decedent left a Will. A temporary administrator may be given authority to dispose of perishable items such as crops. See O.C.G.A. § 53-6-31.

Ancillary Estates.

Although there is provision for ancillary administration under O.C.G.A. § 53-5-33, where land is involved and when the case is uncontested, a certified copy of the Will and authenticated court documents showing admission for probate in another jurisdiction may be filed with the deed records as a muniment of title. See O.C.G.A. § 53-5-47.

Insolvent Estates; priority of claims.

In some estates, there is more debt than money. O.C.G.A. § 53-7-40 dictates the order in which claims are paid when an estate is insolvent. Unless otherwise provided by law, all property of the estate, both real and personal, shall be liable for the payment of claims against the estate in the following order:

(1) Year’s support for the family;

(2) Funeral expenses, whether or not the decedent leaves a surviving spouse, in an amount which corresponds with the circumstances of the decedent in life. If the estate is solvent, the personal representative is authorized to provide a suitable protection for the grave;

(3) Other necessary expenses of administration;

(4) Reasonable expenses of the decedent’s last illness;

(5) Unpaid taxes or other debts due the state or the United States (this is where Medicaid Estate Recovery claims are paid);

(6) Judgments, secured interests, and other liens created during the lifetime of the decedent, to be paid according to their priority of lien. Secured interests and other liens on specific property shall be preferred only to the extent of such property; and

(7) All other claims.

Resources:

- M.F. Radford, Wills, Trusts, and Administration of Estates, 52 Mercer Law Review 481 (2000) for a review of Georgia’s probate code as it existed prior to 1998, noting changes from 1999 – 2000

- D. McGuffey, Medicaid Estate Recovery in Georgia (2009).

- Video Series at Council of Probate Court Judges of Georgia

- Standard Forms from Council of Georgia Probate Judges

- Standard Forms at Georgia Supreme Court website

- Georgia Probate Records

BLOG POSTS

Dementia alone does not prevent someone from executing a valid Will

In Creamer v. Manley, decided March 14, 2024, the Court of Appeals affirmed summary judgment upholding the validity of a Will. In summary, Willifred Thompson executed a Will leaving substantially all of her estate to Mable Manley, her caregiver. Two second cousins, Barbara Creamer and Gordon Lowe, filed a caveat alleging that Thompson lacked testamentary […]

Caveator deprived herself of standing by withdrawing her challenge to Will

On February 21, 2024, the Georgia Court of Appeals decided the case of In Re Estate of Anne Smith Florance. In that case, Florance had executed a revocable trust during her life and a Will pouring the remainder of her estate into the trust. The trust was first established in 1997 and amended several times […]

Probate Court Reversed for Ordering Conservatorship Accounting Before Determining Identity of Estate’s Personal Representative

The Georgia Court of Appeals decided the case of In re Bessie Mae Blake on February 20, 2024. Willis Blake was appointed as his mother’s conservator in 2000, but he was a poor record keeper. Although he was required to set up a separate account for Bessie Mae, keep records of expenses and file annual […]

Georgia Court of Appeals Revisits the Preponderance-of-the-Evidence Standard

In White v. Stanley (Georgia Ct. App. 10/3/2023), Rhonda White appealed a jury verdict in favor of the defendants relating to a motor vehicle collision. White argued that the trial court gave an improper jury instruction regarding the Preponderance-of-the-Evidence Standard. The trial court instructed the jury using the existing pattern jury instructions. However, the law […]

Sometimes You Must Say No

Sometimes you just have to say No “No” isn’t a four-letter word. Saying “no” isn’t necessarily bad and you shouldn’t feel bad when you say it. Part of saying no means taking a stand. It can mean standing up to injustice. For example, our legal system is, for the most part, dependent on people saying […]

Contacting Insurance Companies after a Policy Holder’s Death

After a policy holder dies, it is important to contact insurance companies to see whether a claim should be paid. Types of claims can include: Life insurance payout Refund of unused premiums Indemnities Typically assets with a beneficiary designation are not probate assets and should be paid to the person named as beneficiary. In some […]

Handwriting Expert’s Testimony Supported Forgery Claim Regarding Life Insurance Proceeds

In Estate of Hargett v. Brown (Tenn. App. 6/9/2023), the Decedent, Willie Hargett, had separated from his wife, Robbie Hargett. Despite the separation, there was no divorce. After the separation, Mr. Brown entered into a relationship with Charlotte Brown. The Decedent had legal documents prepared after he was diagnosed with lung cancer. He sought to […]

Settlement of Probate Dispute Enforced As Written

On June 12, 2023, the Tennessee Court of Appeals (Knoxville) upheld a settlement agreement requiring the recipient of funds in an investment account to pay his share of capital gains taxes. The case, In re Hunt, E2022-00649-COA-R3-CV, arose during the probate of Dr. Robert McPhail Hunt, Jr.’s estate. Hunt purportedly married Zulkifli Atim in Canada […]

What is Undue Influence?

In Milbourne v. Milbourne, 301 Ga. 111 (2017), The Georgia Supreme Court affirmed a Gwinnett Probate Court Order refusing to grant summary judgment on the issue of undue influence. Milbourne concerned a Will, allegedly procured through the undue influence of the Will-maker’s sister. The Will-maker was Edison Jamal Milbourne. He suffered a work related brain […]

Uniform Partition of Heirs Property Act

The Uniform Partition of Heirs Property Act (“UPHPA”) has been enacted in 21 States. It is designed to preserve family wealth passed to the next generation in the form of real proeprty. In Georgia, the Act is codified at O.C.G.A. § 44-6-180 through § 44-6-189.1. Initially, when a partition action is filed, the Act requires […]